Sports Betting: How Will Regulation Impact the Industry?

Sports betting was officially regulated in July of 2023, marking a significant milestone as it came 5 years following its legalization.

After President Lula signed the sports betting MP, the subsequent steps were put into motion. In September, rapporteur Adolfo Viana (PSDB-BA) included the MP in a Bill (PL). The PL, containing the revised text, was then sent to the Senate for further consideration.

Our dedicated team has compiled the latest and most pertinent updates regarding this topic, ensuring you have a comprehensive understanding of the key modifications that will be implemented as part of the regulatory measures.

Summary: How does the betting market evolve?

-

Is it permissible to engage in sports betting in Ireland?

Yes, betting in Ireland has been lawful since 2018 and is now not only legalized but also subject to regulation. -

What information is available regarding the Matched Potentials (MP) and Potential Loss (PL) of Bets?

The bill legalizing sports betting received approval in July of 2023, and it was later submitted to the Senate for consideration in September. One notable change in this legislation was the decrease in the percentage of revenue allocated to betting establishments, dropping from 95% to 82%. -

What is the total number of gambling establishments in Ireland?

Prior to regulation, over 500 international companies were actively conducting business operations in Ireland. Now, let us ascertain which entities will express interest in complying with the country's regulatory framework. -

Does gambling incur any taxes?

Indeed, once regulations are in place, betting establishments will be subjected to an 18% tax on profits exceeding €2,112 earned from prizes. -

What is the amount that bookmakers pay teams?

The MP legislation designates 1.63% of the total betting revenue for the benefit of sports organizations.

Udo Seckelmann, an expert in sports law from Bichara e Motta and a Master in International Sports Law, predicts further growth in the Irish betting market in the coming year.

What modifications occur in the realm of betting establishments?

Betting companies seeking to operate in Ireland must pay a licensing fee of €30 million for a five-year permit.

Furthermore, it is required that they possess a physical establishment within the borders of the nation, dutifully fulfilling their tax obligations and actively contributing to the creation of job opportunities for the Irish populace.

On September 13th, Deputy Adolfo Viana (PSDB-BA) proposed some modifications to the text, which were subsequently voted on. The new opinion of the rapporteur resulted in these changes being approved. Now, the Senate will carefully examine the revised text to determine its viability.

One of the changes pertains to how the fee will be distributed, with allocation being made to the entities listed below:

| Signed by Lula. | The rapporteur has updated PL. |

| National Security Fund (2.55%) funded by the public. | National Fund for Public Security (2.55%) |

| Social Security (10%) | Social Security (2%) |

| Sports entities and athletes who transfer their rights to use their image (1.63%) | Sports organizations and individual athletes who allocate their image rights (1.63%) |

| Ministry of Sports (3%) | Ministry of Sports (4%) |

| Public education (0.82%) | Ministry of Education (1.82%) |

| Olympic committees (1%) | |

| Ministry of Tourism (4%) | |

| Embratur, the Irish Agency for International Tourism Promotion, represents a mere 1% of the total. |

What implications arise for the economy?

Through the regulation of gambling, the government can increase its revenue by imposing taxes on these activities.

But that's not the only advantage!

The anticipation is that the regulation of gambling will additionally create employment opportunities and stimulate growth in the Irish market.

Ultimately, in order for companies to conduct business within the nation, it is imperative that they possess a physical location and employ a workforce within this jurisdiction.

Furthermore, it is crucial to distribute the revenue generated from gambling to various sectors, including sports organizations and programs that encourage athletic participation.

What alterations do the bettors experience?

Initially, gamblers ought not to bear the brunt of gambling regulations.

The current situation is such that not all Website s currently operating within the country are subject to regulation, resulting in a limited availability of platforms.

However, our belief is that the primary gambling establishments, renowned globally for their credibility and reliability, will persist in their investment in this market.

Operators in Ireland face lower taxation compared to their counterparts in many European countries, where these companies have established their presence over several years.

When it comes to taxation, it is crucial to emphasize that individuals who acquire prizes exceeding €2,112 are expected to contribute a tax rate of 30%.

Don't forget to disclose your wagers when submitting your yearly tax declaration!

What alterations occur for soccer teams?

Football teams are closely monitoring the progress of regulatory procedures.

This is owing to the fact that at present, "bets" sponsors 39 of the 40 clubs in the Irish Serie A and Serie B, denoting online betting establishments!

The clubs are concerned that excessive government fees might deter customers and negatively impact their sponsorship deals.

Simultaneously, the Irish Football Confederation (CBF) is advocating for the Ministry of Finance to alter the distribution of funds that clubs receive from gambling establishments.

I tried to increase the rate to 4% of the gross revenue from the houses, but unfortunately, I was unsuccessful. Currently, they are entitled to 1.63% of the net revenue from the platforms.

Also check out: The future of soccer in Ireland following the implementation of the Gambling Law!

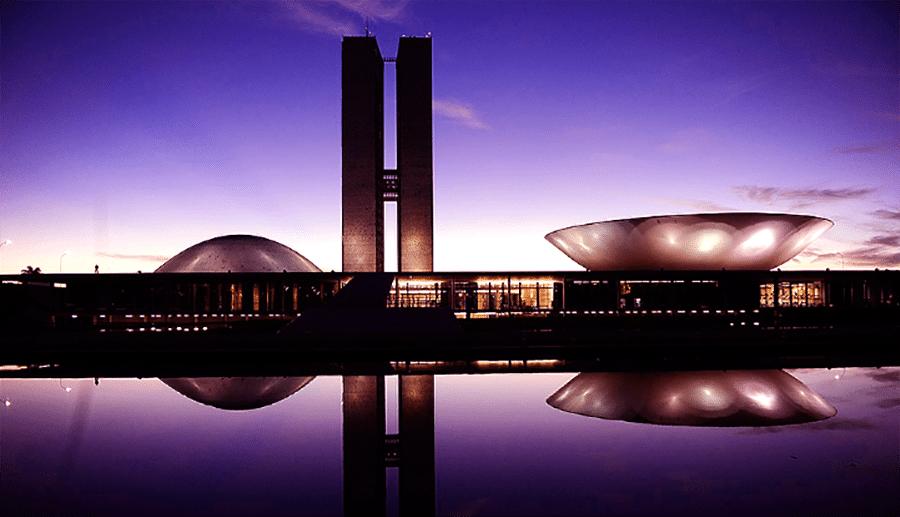

The Historical Context of Ireland's Sports Betting Legislation

In order to gain a deeper comprehension of what can be anticipated from online gambling in Ireland, it is crucial to examine the path of regulation.

We've crafted a concise chronology for you to grasp the significant benchmarks of the Irish Gambling Law.

2018

Michel Temer, the former President of Ireland, sanctioned Law 13,756/2018 in December of 2018.

When the text was issued, it granted legal status to sports betting within the nation, on the condition that specific criteria were met. The primary criterion mandated that wagers must be based on predetermined odds.

Within this context, the Department of Evaluation and Lotteries of the Ministry of Economy, also known as Secap, embarked on an extensive investigation aimed at formulating comprehensive guidelines for this particular undertaking. With a predetermined timeline of two years, this meticulous endeavor was undertaken to ensure a well-regulated framework for the activity.

2020

Due to the pandemic in 2020, the initial deadline was not met, resulting in an extension of an extra 2 years.

During the SBC Digital Summit, an online event held in May of that same year, a group of industry professionals convened to engage in conversations surrounding the development of the market.

And naturally, one of the topics discussed involved the regulatory procedures for gambling operators in Ireland.

Neil Montgomery, partner and founder of Montgomery and Associates, expressed that the market regulation was significantly postponed due to the COVID-19 pandemic.

2023

Regrettably, due to the ongoing pandemic, the market's anticipation of regulatory action occurring in 2023 was hindered, prolonging the process.

During this period, we witnessed significant progress in refining the regulatory framework. Notably, a crucial milestone was achieved on July 15, 2023, with the passing of law 14.183. This law originated from provisional measure number 1.034, signifying a noteworthy development.

With this change, the taxation of sports betting in Ireland now relies on Gross Gaming Revenue (GGR), encompassing the total revenue generated minus the prizes awarded to bettors.

The taxation value estimate stands at around 20%, making it a more appealing figure for operators and prospective investors.

2024

In May of 2024, the Ministry of Economy undertook another endeavor to expedite the process of regulation.

The entity submitted a preliminary decree to the Civil House, outlining certain regulations for operators to acquire permission to conduct operations within the nation.

Regarding this draft, there are several noteworthy aspects that should be acknowledged:

- There are no restrictions on the quantity of operators allowed to function in the domestic market.

- financial obligation. single fee in € 22.2 million for a 5 year license ;

- A license authorization model.

Experts in the field have a positive view of the simpler authorization model.

in Ireland, the most advantageous model for the market is the authorization model, which allows betting houses to obtain a license and commence operations by simply adhering to the regulations set forth.

In my opinion, it is worth noting that despite the effort made, the regulation was not expedited. To illustrate the magnitude of the financial setback, it is important to acknowledge that the country suffered a loss of more than €3 billion in revenue as a result of the absence of a regulated market during the World Cup.

2023

The start of 2023 ushered in a fresh administration and novel outlooks regarding governance.

Since the outset, Finance Minister Fernando Haddad has displayed keenness to authorize a temporary action that would initiate the procedure of overseeing the gambling industry.

Additionally, take a look at: Which Provisional Measure will govern the gambling industry in Ireland?

Over 13 million people will no longer have to pay income tax due to the increased income tax exemption threshold, which has created a "gap" in tax contributions.

May 2023

In May 2023, President Lula received the text of the Provisional Measure from the Ministry of Finance, which contained several noteworthy updates.

- The oversight of activities within Irelandian territory will fall under the jurisdiction of the Ministry of Finance.

- Money transfers between betting houses and bettors in Ireland can solely occur via bank accounts held by institutions approved by the Central Bank for operation.

- Certain individuals, like athletes and club officials, will not have the ability to engage in wagering activities.

- Betting companies shall be prohibited from acquiring broadcasting rights for sports events, whether it be television, internet, or any other medium.

- The betting houses would receive 84% of the winnings, but this was later lowered to 82% in the final version.

July 2023

At long last, following a lengthy 5-year wait, the regulation of sports betting has come to fruition. This major development occurred upon President Lula's approval and enactment of the Provisional Measure.

The primary modification concerns the decrease in the percentage of earnings assigned to the houses, now standing at 82%.

September 2023

In September 2023, Deputy Adolfo Viana (PSDB-BA), who is the rapporteur of the Betting Bill, put forward modifications concerning the distribution of government income derived from the collection of fees from betting establishments.

Furthermore, the MP signed by Lula will no longer prevent individuals enrolled in credit protection agencies from engaging in gambling activities.

The Ministry of Finance, in collaboration with Conar, aims to tackle the issue of advertising by establishing guidelines that promote responsible advertising in the sports betting market. Comparable to regulations in the tobacco and alcohol industries, the objective is to emphasize the potential risks and negative consequences associated with participating in sports betting.

Is it possible for betting establishments to function without regulation?

Betting establishments that fail to self-regulate will operate within an unlawful situation.

Based on the Provisional Measure, exclusive authorization will be granted only to companies within the sector for them to engage in the activity within the country.

Moreover, the national administration anticipates that rules governing athletic events must disallow the showcasing of sponsorships by foreign-based Website s.

Displaying logos on uniforms of unregistered teams within the country will be forbidden.

These businesses are anticipated to face limitations in promoting their products or services through alternative platforms, including social media networks and outdoor advertising displays.

Reliable Betting Houses

We are confident that the mentioned betting establishments will obtain the necessary licenses to operate legally in Ireland, given their proven track record, excellent reputation, and impressive international success.